Last week, one member of the Platte County Commission responded to the Platte County Treasurer’s stance against approval of the proposed half-cent law enforcement sales tax.

Presiding Commissioner Scott Fricker released a statement addressed to Treasurer Rob Willard on Monday, July 1, stating his concern that should “key variables in this deal (sales tax growth rates and interest rates) go against us, this project is under water.”

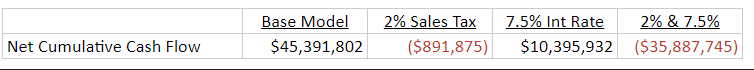

The statement included a table that Fricker said shows the total net cumulative funds remaining at the end of the 20 year sales tax assuming a) the base model - 3% sales tax growth rate and 4.5% interest rate, b) the sales tax growth rate is actually 2%, c) the interest rate is actually 7.5%, and d) both of those things happen.

“I understand your position on this and clearly you’re not alone,” Fricker said. “But we have two responsibilities here -- to provide adequate inmate housing for the county and to make sure the county remains solvent. If we followed your advice (which was never given until after we put this on the ballot even though you could have discussed this with us any time during the previous six months while we were working on this) and these assumptions go against us, the county would be forced to impose a major property tax increase to fund the shortfalls. And that wasn’t an acceptable option for us.”

Further, he said, if the assumptions break in the county’s favor, future commissions can choose to not renew the law enforcement sales tax, which would save taxpayers $123 million by the end of the 20 year term. They could also reserve excess funds so that we could pay cash for the renovations that will absolutely be necessary after 20 years.

“As you know, it’s very hard to project anything past three to five years and anyone can always poke holes in long-term projections,” Fricker said. “But this is our job and we stand by our proposal.

He ends the statement by stating if Willard would like to discuss the law enforcement sales tax, the Commissioners’ door is open.